Engineering

Just a few days after the insolvency proceedings were opened, the process of finding an investor for Maschinenfabrik Möllers GmbH was successfully concluded. The Arodo Group from Belgium will take over the business and keep on around half of the mechanical engineering firm’s employees. An interim employment company will be set up for the workers who can no longer be employed. The coronavirus pandemic and the postponement of orders had led to liquidity problems for Möllers and insolvency became inevitable. During the proceedings, the PLUTA team kept the business operational and launched the process of finding an investor, which was successfully concluded. The solution achieved ensures the best possible satisfaction of creditors and the company’s preservation. The long-standing company has been developing and manufacturing material filling, palletising, packaging and loading machines and equipment since 1952.

Logistics

The creditors of W & F Franke Schwerlast Internationale Spedition GmbH can be pleased with an initial dividend distribution of 52.6%. A total of 1.87 million euros have therefore been paid out already. An overall insolvency dividend of at least 80% is expected in the proceedings. The successful continuation of the business and the investor solution found were key factors in this outcome. This is now also reflected in the exceptionally high recovery rate. W & F Franke had specialised in transporting oversized and very heavy goods as well as truck transports. The forwarding company had to file for insolvency due to liquidity problems. However, the PLUTA team kept the business operational during the proceedings. Thanks to the investor solution found, over 90% of the employees have retained their jobs.

Tourism

The coronavirus pandemic is causing great difficulties in the restaurant and hotel sector in particular. Tidal Operations Germany GmbH could not escape the effects, either, and filed for insolvency. The company operates eleven hotels in major German cities under the Holiday Inn, Holiday Inn Express and Crowne Plaza brands. The hotels did not generate any revenue because of the lockdown. Under difficult conditions, the PLUTA team thus initiated an investor process together with the landlords to find a new operator for the hotel portfolio. In the end, the Westmont Hospitality Group, a leading international hotel operator, took over the running of the hotels. The investor is thereby strengthening its own position in the market. Thanks to this solution, all of the some 300 jobs have been saved.

Logistics

The Diedrich Meyer GmbH & Co. KG forwarding company from Bremen has been in business for more than 120 years, having been founded back in 1897. The forwarder handles the short-haul and long-haul transport of containers and bulk materials, for example, and also offers the storage and unloading of shipping containers. Ultimately, the coronavirus pandemic posed major challenges for the forwarder and it had to file for insolvency due to liquidity problems. After the application had been filed, the insolvency administrator and his PLUTA team launched the process of finding an investor. They managed to achieve a welcome outcome: a well-known investor from the region took over the business operations and the employees.

Food Production

Good news for a long-standing Gundelfingen business: a craft baker will take over the Bäckerei Lindenthal bakery operation. A large number of the jobs have been saved through the investor solution. The bakery experienced liquidity problems caused by a number of factors, including the coronavirus pandemic. The insolvency administrator kept the long-standing business operational together with his PLUTA team. A suitable buyer was ultimately found. Thanks to the solution, the bakery location will also be maintained. The investor already owns several bakery stores and will keep the long-standing business going under his own name. In the future, the Gundelfingen store will sell baked goods made at the investor’s established production location.

Pharma

Founded back in 1988, Teccom Pharma GmbH from Sarstedt, a town located near Hanover, initially focused on consumer goods retailing. The company then specialised for many years in trading pharmaceuticals and related logistics. Teccom Pharma had a some 1,500 m2 warehouse and logistics site. The company had to file for insolvency due to liquidity problems and coronavirus-related sales and delivery issues. The local court appointed a PLUTA restructuring expert as insolvency administrator. Together with his team, he started the process of finding an investor for the pharmaceutical wholesaler and achieved a solution: two investors will acquire the company’s assets. Several staff members have already found other employment opportunities in the region. In order to further increase the recovery rate for creditors, the PLUTA team is now engaged in reviewing and asserting considerable liability claims and claims brought to contest debtor transactions under insolvency law.

Aviation

The coronavirus pandemic has posed major economic challenges for the entire aviation industry, with travel restrictions having led to a fall in passenger numbers. Paderborn Lippstadt Airport has not escaped these effects. Given the steep decline in aircraft movements, the airport had to file an application for the opening of debtor-in-possession insolvency proceedings. A PLUTA expert was appointed insolvency monitor, in which role he oversaw management and ensured creditors’ rights. After just six months, Paderborn Lippstadt Airport became the first regional airport in Germany to reposition itself on a sustainable footing under its own steam. The creditors’ assembly approved the insolvency plan. This meant the restructuring could be completed, with a 25% insolvency dividend being distributed to the creditors. Thanks to the successful debtor-in-possession proceedings, the airport can return to regular business operations.

Logistics

Lottmann GmbH & Co. KG from Aurich in East Frisia has been delivering goods for many years for customers in the drinks, wood, steel and construction materials sectors. It has a fleet of 14 tractor units and 21 semitrailers. The company had to file for insolvency due to liquidity problems. The insolvency administrator and the PLUTA team kept the business going, initiated the process of finding an investor and were able to achieve a solution for the family business: a well-known investor from the region took over the business operations, including the fleet and all employees. The long-established company was founded back in 1896 with its first horse-drawn carriage. Today, this modern transport and logistics company covers a broad range of services. The forwarder has two sites and employs around 120 people.

Care/Nursing Home

People who require assistance and the elderly depend on support in various parts of everyday life, whether for going shopping, keeping doctor’s appointments, dealing with authorities or even getting a haircut. The employees of ReWa GmbH make it possible for them to participate in society and ease the stress on family members. The company providing support for daily living filed for insolvency due to liquidity problems. The PLUTA restructuring experts launched an investor process and were able to save all of the jobs thanks to the outcome achieved. The employees have welcomed the successful takeover. The buyer comes from the industry and has already been helping to foster the independence and well-being of people in need of care since 2005.

Human Resources

A lot of companies faced serious economic challenges during the first COVID-related lockdown, including FAIR Personal + Qualifizierung GmbH & Co. KG from Ahaus. Ultimately, significant sales losses led the personnel service provider to file for restructuring under debtor-in-possession proceedings. The intention behind this was to enable the company to overcome the consequences of the pandemic, adapt to the changing market and prepare for the post-coronavirus period. In cooperation with the managing director and the restructuring expert appointed by the company, the experts managed to keep the business going. At the same time, various structural changes were implemented and an insolvency plan was drafted so that the personnel service provider could continue to offer its customers personnel leasing, placement and training services in the future. The restructuring was completed and the creditors unanimously approved the insolvency plan. The successful debtor-in-possession proceedings saved 300 jobs. The PLUTA expert was involved in the proceedings as insolvency monitor and represented the interests of the creditors.

Engineering

Employees of a mechanical engineering company from Eggolsheim, near Bamberg, can look positively to the future: an investor has been found for Stefan Plätzer Maschinenbau GmbH. The company felt the heavy effects of having grown too fast and invested too much, the drop in demand in the automotive sector and the challenges of the COVID-19 crisis. After the company had filed for insolvency, the PLUTA team kept the business going and, in tandem with management consultancy CONSABIS, launched a process aimed at finding an investor. An investor from the region with a history spanning over 240 years ultimately took over the business operations and kept on almost all employees. The previous managing director has also remained on board. The Stefan Plätzer Maschinenbau site has been saved as a result of the takeover. The new site is a good fit for the investor’s growth strategy and means it will be very well positioned for the future with two plants.

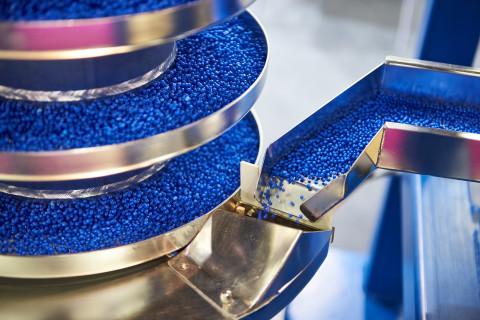

Plastics Processing

Injection moulding manufacturer Bock from Lauterbach specialises in plastics technology. Although founded in 1946, the long-standing company’s origins go back to the year 1866. Bock GmbH & Co. KG develops and produces injection moulded and composite parts in line with the specific characteristics of plastics. The company had to file for insolvency due to liquidity problems. Its financial situation was additionally impaired by the fact that its smaller factory had to be moved to new premises. Given the good order situation in the main factory, however, the company was in a position to continue operating in the medium term. The experienced PLUTA restructuring team kept the business going for almost a year and began the process of finding an investor. This proved difficult given the economic challenges associated with the coronavirus pandemic. Nevertheless, the experts held countless discussions with potential investors until they finally achieved a solution: a competitor from the region took over Bock’s business operations. The restructuring team was thereby able to secure 40 jobs.

Electronics

MTA Prototyping GmbH from Nordhalben primarily stood out on account of its high-quality prototype solutions for the automotive sector. The innovative system supplier’s offering included individual components and package solutions as well as full service prototyping for the development of new products and tools. Both the coronavirus pandemic and structural changes in the automobile sector led to liquidity issues for this company, which operated in the automotive and exhibition stand construction industries. After the company had filed for insolvency, the employees and managing director showed great commitment and therefore played a significant role in the investor solution achieved. The PLUTA restructuring expert was able to find a suitable investor, who took over the business operations by way of an asset deal. The system supplier’s employees can now continue to manufacture high-quality prototypes under the new name of MTA Technical Solutions. Most of the employees and the former managing director have remained on board.

Bio Gas

The business idea is especially sustainable: MicroPyros GmbH has developed a process for producing eco-friendly methane. Energy producers can all but double the methane content of their biogas from approx. 50 percent to almost 100 percent using the technology. The start-up from Bavaria had to file for insolvency due to liquidity problems. A PLUTA attorney was appointed insolvency administrator. The company remained fully operational. A feasibility study was conducted for a plant for a major European customer during the provisional proceedings. After many discussions, the insolvency administrator sold the business to an investor in the industry. It has taken on all employees and will develop the innovative technology to marketability.

Bicycle

LifeCycle GmbH is an innovator and trendsetter: as Germany’s first professional bicycle service provider, the company has been offering bespoke mobility solutions for companies, bicycle manufacturers and direct marketing brands since 2016. Although represented in a number of key locations, the company still had to file for debtor-in-possession proceedings. Just three months later, a solution in the form of an investor was found for LifeCycle in spite of the challenging macroeconomic environment. The Govecs Group, a manufacturer of electric scooters and mopeds and transport vehicles, took over the business and kept on all remaining employees. The PLUTA restructuring experts supported management during the discussions with investors and helped them to restructure the bicycle service provider’s operations.

Bearing Technology

The warehouse technology company Schwab Förder- und Lagertechnik GmbH has a long history, having been founded in Chemnitz back in 1933. Its headquarters had been located in Oettingen since 1947. The company specialised in individual system solutions designed for space-saving and flexible goods storage. It had to file for insolvency due to liquidity problems. The PLUTA expert appointed insolvency administrator by the court held discussions with several interested parties and was able to find a buyer from the region: a specialist in the processing of steel and a supplier to the plant and mechanical engineering industries has acquired the business operations of the long-established Bavarian company by way of an asset deal.

Care/Nursing Home

Good news for the Diakonische Altenhilfe der Region Hildesheim gGmbH elderly care facility from the Hildesheim region and its employees: just seven weeks after proceedings were initiated, the care facility has successfully completed self-administration. The creditors agreed to the insolvency plan that was submitted. This will save 330 jobs, and the facility will be preserved for its residents. Despite the coronavirus restrictions, business operations continued during the insolvency. The planned change of the supporting body opens up sustainable future prospects for Diakonische Altenhilfe. A PLUTA attorney acted as custodian in the proceedings and supervised the proceedings on behalf of the creditors.

Care/Nursing Home

The employees and residents of Meinersen House could heave a sigh of relief. The restructuring experts at PLUTA had come up with an investment solution for the company and found a well-known investor. Therefore, the future of this care facility in a north German community was secured. Prior to this, the insolvency administrator and his team had continued to run the business in its entirety after the application was made. The employees remained on board during the procedure and the continuation of high-quality care for the residents was therefore ensured. Everyone involved welcomes the fact that the facility will continue to run with all its employees and residents in the same location.

Care/Nursing Home

Some 220 employees look after the needs of senior residents in the Bayerisch Gmain Pflege- und Therapiezentrum GmbH. The centre had to file for debtor-in-possession proceedings in order to ensure the company’s long-term survival in the interests of patients, employees and creditors. And that is what has been achieved: the care and therapy centre remained fully operational during the proceedings, with some 300 residents receiving professional care. The administration functions and service companies were reorganised during the restructuring. Moreover, rental agreements were renegotiated. The proceedings were concluded after more than two years. Creditors are set to receive a fixed cash dividend of approximately 30 % and will also share in the proceeds of the planned sale of the centre. A PLUTA expert oversaw the proceedings as insolvency monitor in the interests of creditors.

Brewery

Bürgerbräu Wolnzach AG from Bavaria in Germany had to file for insolvency due to liquidity problems. A PLUTA restructuring expert acted as insolvency administrator. He kept the brewery’s business operations going and held negotiations with several interested buyers. Although the small brewery ceased brewing beer, the insolvency administrator was able to continue selling beer as the company’s warehouses were well stocked. Finally, it was possible to sell the brewery. The buyer originates from the Upper Bavaria region but has been living in the US for several years, where he successfully operates two breweries. Having found a buyer with roots in the region, the PLUTA team achieved the best solution for the brewery and the creditors. This also means that this region, home to the German Hop Museum, will still have a brewery in future.

Leisure, gastronomy

Insolvency proceedings for the assets of Lielje Immobilien GmbH & Co. KG from Lower Saxony in Germany were opened in spring 2017. The company operated the well-known Ith-Sole-Therme, a thermal spa offering a pool area, various saunas, a restaurant, wellness services and more. The PLUTA restructuring experts kept the business running for nine months, during which time visitors had access to all facilities, without restriction. Following intensive negotiations, the PLUTA team found a solution and sold the business to a group of seven investors, all of whom came from the region and felt it was very important to maintain the spa. All jobs and the popular leisure facility in this rural part of Lower Saxony were thereby secured.

Events

The coronavirus pandemic has dealt a particularly severe blow to the trade fair and event industry; declines in sales due to lack of orders and cancelled shows have led to insolvencies in the sector. This makes the investor solution achieved by the PLUTA team for hms easy stretch GmbH based in Heilbronn all the more pleasing. A medium-sized investor from the region has taken over the trade fair service provider’s business operations and its employees. The company continued operating without restrictions in spite of filing for insolvency, with stricter hygiene measures in place. The PLUTA team also opened up another business area during the proceedings: the company has been producing reusable face masks, which are in great demand. The investor is convinced by the brand, the existing business areas and the high product quality, and wants to see all areas continue operating.

Retail

matratzen direct AG, a mattress retailer with 558 employees and 256 discount stores, applied for debtor-in-possession insolvency proceedings in early 2017. Under such an arrangement, management remains in charge and guides the company through the crisis itself. A PLUTA expert was appointed insolvency monitor to supervise the restructuring process and protect the interests of the creditors. The company had fallen into financial difficulties due to a dramatic decline in sales after it was required under competition law to change its former name “Factory Outlet”, which had been very useful in its advertising. The business was kept operating in full during the insolvency proceedings and an insolvency plan in which creditors agreed to waive part of their claims was drawn up. In total, 176 stores and 410 jobs were saved. Insolvency proceedings were terminated in late 2017.

Tourism

There is good news for the ski resort in the Allgäu region. After an insolvency filing, things are looking up again. The PLUTA insolvency law experts were able to find an investor for Grüntenlifte. In addition to the ski amenities, the investor from the region also plans to create a year-round family-friendly mountain attraction. New gondola and chair lifts, a natural toboggan run and an extended network of hiking trails will ensure that visitors can enjoy the Allgäu’s pre-alpine scenery. The sale was very challenging, as the PLUTA experts not only negotiated an extensive array of contracts, but also had to take into account different ownership structures and more. The notary appointment alone lasted 14 hours, which shows how complex the matter was.

Fashion

A last-minute solution was able to be found during the self-administration proceedings of the well-known G-fashion Group. Despite the difficult conditions caused by the corona pandemic, an investor was found. While the investor process was ongoing, the textile retailer had to temporarily close its branches due to the lockdown. The contracts for the transferred restructuring, which had already gone through final negotiations, could therefore no longer be concluded as planned. While the management was already preparing to shut down operations and the branches were carrying out clearance sales after being partially opened, an agreement was finally reached with an investment company. Numerous employees have therefore kept their jobs. The PLUTA experts acted as custodians for three companies in the group and supported the proceedings in the interests of the creditors.

Gastronomy

The Tiziano Gelati brand is known for its three ice-cream parlours and one restaurant in northern Germany. Nevertheless, the company had to file for insolvency: proceedings were ordered in summer 2015 and a PLUTA attorney was appointed insolvency administrator. A few months later, the PLUTA team was able to sell the business with the consent of the creditors’ assembly. The buyer has experience in the industry and is successfully operating in other German locations. All staff were kept on. The creditors received a higher-than-average double-digit recovery rate on their claims.

Gastronomy

Pizza, pasta and salads: listed restaurant chain Vapiano SE has a varied Italian menu. Its ‘fast casual’ restaurants offer freshly prepared products and a speedy service. However, Vapiano was forced to file for insolvency due to liquidity problems, declines in sales and government-mandated restaurant closures relating to the COVID-19 pandemic. Two PLUTA restructuring experts were then appointed insolvency administrators for the parent company and several subsidiaries. The PLUTA team worked with the Vapiano management board to find an investor. In the end, an investor group acquired a majority of the restaurants in Germany and France. The national and international franchise business has also been sold. This solution has saved many jobs.

Logistics

Changes in the wind energy industry have a direct impact on companies in other industries – such as the logistics expert W&F Franke from Bremen. The north German company had been carrying out most of its transport for customers in the field of wind power. Then W&F Franke had to file for insolvency. The restructuring experts at PLUTA continued to run the business in its entirety after the application was made and eventually found an investor. A serial entrepreneur with headquarters in Bremen, who is well-known far beyond the immediate area, took over the business. An excellent outcome in that the vast majority of jobs have been retained.

Construction

The construction company Heinrich Kütemeyer Baugeschäft GmbH from Hanover was founded back in 1933. It worked for many regional housing companies and cooperatives. Customers in the region trusted its high-quality and reliable management of construction projects. Nevertheless, the construction company had to file for insolvency under debtor-in-possession proceedings due to imminent illiquidity. In spite of the challenges posed by the COVID-19 pandemic, the PLUTA expert managed to find an investor. The work is now set to be continued under a new company name. The investor is from the region and has been offering complete solutions in relation to various construction activities since 1954. All employees have been kept on.

Metal Construction

The insolvency law experts from PLUTA Rechtsanwalts GmbH found an investor for Straubinger Metallbau GmbH, based in Bavaria. The company, which has been operating for more than 40 years, filed for insolvency due to liquidity problems. Its core competencies lie in metal and steel construction and fire protection measures. In this area, the company also advises architects and building contractors. The buyer is the former managing director, who set up the company and then successfully managed it for years. Under the asset deal, this long-standing company will retain its name and all jobs have been saved.

Metal Construction

PLUTA renovation expert Florian Schiller reached an agreement at the last minute for Maier Drehtechnologie GmbH from Baden-Württemberg. An investor from the region bought the company. Previously, the insolvency administrator and his team had continued operations without restriction. He is confident that the new shareholders will lead the company to a successful future. They want to reorganise processes and modernise operations. Very encouraging: all top customers are still on board, and the buyer is taking over almost 50 of the approximately 70 employees last recorded. The sale took place under great time pressure and was therefore a challenge for everyone involved.

Agribusiness

The management of Münsterländische Margarine-Werke J. Lülf GmbH, a supplier of margarine and fat products as well as milk drinks, conducted debtor-in-possession insolvency proceedings. Under such an arrangement, management remains in charge and guides the company through the crisis itself. A PLUTA expert acted as insolvency monitor, supervising the restructuring process in the interests of the creditors. The insolvency was mainly the result of the adverse market situation and the decline in demand in the lower-margin margarine segment. Business activities were maintained without restriction during the proceedings, and an investor was sought. The successful bidder presented an acquisition concept that would retain the most jobs. A total of 49 jobs were saved as a result.

Engineering

The Haugg Group based in Aachen has successfully completed its restructuring with the third protective shield proceedings for its subsidiaries in the south of Germany. The specialist in thermal management solutions for vehicles and industrial applications produces special coolers for agricultural machinery, construction equipment and high-speed trains. The subsidiaries focus on development, design, logistics and quality management, while production is concentrated at the Aachen site. In the course of the restructuring, Haugg moved production of standard coolers to China, as this was no longer competitive in Germany. The creditors approved the insolvency plans presented. A PLUTA attorney oversaw the proceedings as insolvency monitor in the interests of creditors.

Engineering

An investor solution for a traditional company after only four months: the history of WPM Werkstoffprüfsysteme GmbH goes back to 1881. The scope of activities of the company, which grew out of a small craft business, can thus be preserved. Dr Stephan Thiemann from PLUTA found a strategic investor for the company. It is taking over all employees. National and international customers can also breathe a sigh of relief. Because the testing machines by WPM are used by well-known manufacturers from a wide range of industries for improving their own products and ensuring a long service life.

Engineering

Precision technology from Baden-Württemberg is here to stay. Steffen Beck from PLUTA was able to find a successor solution for Schmid Solution GmbH & Co. KG. The company near Stuttgart develops and manufactures clamping devices for machine tools in the field of precision technology. After filing for bankruptcy, the PLUTA expert and his team continued operations without restriction. The insolvency administrator spoke to investors at the same time. After only three months, the PLUTA team was able to find a buyer, who took over all the remaining employees.

Engineering

Two long-established companies restructured under debtor-in-possession proceedings could heave a sigh of relief: the creditors’ assemblies of Gustav Knippschild GmbH and Sander Maschinenbau GmbH & Co. KG unanimously approved the insolvency plans presented to them. This ensures the survival of the two closely linked companies. Gustav Knippschild GmbH specialises in the production of large ready-to-assemble steel components for the construction machinery industry. Sander operates in the metalworking industry, covering areas such as conventional machining, CNC processing and the manufacture of steel and welded constructions. Almost all jobs were saved through the debtor-in-possession proceedings.

The PLUTA restructuring experts supported management at both companies during the restructuring. The proceedings were concluded within less than six months, a short space of time that reflects the excellent cooperation of all involved.

Human Resources

Job Find 4 You Personalmanagement GmbH has used debtor-in-possession proceedings to restructure itself. The temporary employment agency’s creditors have unanimously approved the restructuring plan. Specific legal changes in the temporary employment market and an economic slowdown caused by the COVID-19 crisis meant that restructuring measures were urgently needed. A positive outcome has been achieved in spite of the difficult market environment created by the coronavirus pandemic. 150 jobs in the western Münster region have thus been saved. A PLUTA attorney oversaw the proceedings as insolvency monitor in the interests of creditors.

Wood Processing

Personalised customer care, premium products and German quality. All signs point towards a positive future for Warendorf – Die Küche GmbH. The PLUTA restructuring experts were able to successfully keep the kitchen manufacturer’s business operations going and find an investor four months after the company had filed for insolvency. With a new investor from Hong Kong and a new name – now Warendorf Küchenfabrik GmbH – but the same high quality with a “made in Germany” guarantee, customers worldwide will welcome the solution achieved. This is also a positive result for employees. Most of the some 110 original jobs have been saved through the takeover.

Wood Processing

The history of the furniture supplier Karl W. Niemann GmbH & Co. KG goes back to the year 1832 when

Friedrich Wilhelm Wilcke opened his joinery. The PLUTA team was able to secure the future of the long-standing company and its subsidiary. A renowned investor who attaches great importance to sustainable production took over both the furniture supplier and the subsidiary Niemann Formholztechnik GmbH & Co. KG. Both companies had filed for insolvency due to liquidity problems. A PLUTA attorney was appointed insolvency administrator. Together with his team, he continued the business operations of the two companies in full despite the challenges posed by the coronavirus pandemic. The investor solution secured the vast majority of jobs.

Wood Processing

Good news for creditors of Richard Frank GmbH: the PLUTA restructuring team achieved a recovery rate of 84% – with almost a million euros distributed among creditors. It was not possible to restructure the insolvent manufacturer and fitter of parquet flooring. This meant that the business had to cease trading a few weeks filing for insolvency. However, the parent company of this long-standing Stuttgart operation was able to sell its premises at an attractive purchase price. The assertion of liability claims and claims brought to contest debtor transactions as well as the collection of significant receivables owed by the parent company to Richard Frank GmbH led to such a high recovery rate for the creditors.

IT

A rare but welcome outcome: all claims filed by the creditors of DiOmega GmbH have been fully satisfied. The provider of custom IT and web solutions, with a focus on multimedia and mobile applications, had to file for insolvency due to liquidity problems. Its customers mainly included TV stations. Thanks to the employees staying on board, the company was able to complete all pending orders and thereby increase the estate. Unfortunately, it was not possible to find an investor. However, as highly qualified programmers, the app developer’s employees quickly found new employment.

Electronics

The Hello Vape GmbH retail chain sells e-cigarettes and associated equipment. Although it opened shops all over Germany within just a few months and was on an upward trajectory, a partner unexpectedly refused to provide funds to finance the company’s growth. Hello Vape was left with no choice but to file for insolvency. The PLUTA expert appointed insolvency administrator kept the business operating under difficult conditions, with almost all shops having to be closed in the meantime due to the COVID-19 pandemic. Nevertheless, he still managed to secure a strategic investor for the business and ensure the e-cigarette reseller’s future. The vast majority of the employees have been kept on by the buyer.

Tourism

The well-known founder of the JT Touristik travel agency built the company into a familiar brand in the tourism sector. Nevertheless, an application for insolvency followed in the summer of 2017. The PLUTA restructuring experts ensured during the proceedings that more than 10,000 trips went ahead for more than 30,000 holidaymakers. A solution followed in late 2017 – the business was sold to the discounter Lidl, which strengthened its own travel business with the acquisition. All jobs were saved through the solution, and the familiar JT Touristik brand is still in use.

Tourism

DORINT Hotel in Augsburg GmbH & Co. KG filed for debtor-in-possession insolvency proceedings in spring 2016. The investment company owned the hotel in the Bavarian city’s impressive tower. During the proceedings, the hotel remained fully operational and was not affected by the holding company’s insolvency. After considerable, complex negotiations and a bidding process with more than 30 potential buyers, an investor was found just a few months later. Management remained in charge and guided the company through the proceedings itself. A PLUTA expert was appointed insolvency monitor by the court to support the debtor-in-possession proceedings in the interests of the creditors. In the end, the proceedings also paid off for the creditors, who received a 100% recovery rate.

Food Production

The family company’s success story began in the eighties, when KARMEZ Dönerfabrik brought the first industrially manufactured doner kebab skewer to the market. But the company had to file for insolvency. The PLUTA experts were able to keep the long-established company going and find an investor. This means that the high-quality doner kebab skewers will still be produced in Frankfurt in the future. By selling the business, PLUTA has achieved the best possible result for the company, the staff and the creditors. More than 60 employees were taken over by the buyer.

Food Production

Bagel Bakery GmbH, which supplies its customers with authentic American baked goods, had to file for bankruptcy and started the restructuring process under its own administration. Together with experienced restructuring experts and the court-appointed trustee from PLUTA, extensive measures were developed as part of the restructuring concept. The restructuring measures were then consistently implemented and the customers and employees remained loyal to the company. Just a few months later, the creditors and the court accepted the insolvency plan without a single dissenting vote. A gratifying result, allowing the East German producer of baked goods to look to the future with optimism.

Food Production

The family business Leysieffer GmbH & Co. KG is known throughout Germany for the production and distribution of very high quality confectionery products. Leysieffer also operates its own cafés at selected locations. Nevertheless, the company had to file for debtor-in-possession proceedings. The aim of the process was to regain a competitive position in the highly competitive market. Business operations continued without restrictions; immediately after the application was filed, extensive restructuring measures were initiated and implemented in coordination with the PLUTA insolvency monitor. At the same time, those responsible started an investor process, which was also comprehensively supported by the Leysieffer family of shareholders. Just under a year after the application was filed, the process was successfully completed, as an investor was found. 260 jobs were saved by the agreed solution. Creditors also benefited: they received an above-average quota of around 65 percent.

Real Estate

The retail investor Treveria had to file an application for insolvency for 36 German companies. The purpose of these companies was to own and manage the properties held. The real estate portfolio mainly consisted of large retail properties. The PLUTA experts were able to successfully conclude the sale of the Treveria Silo-C real estate portfolio in 2017. At the beginning of the proceedings, the PLUTA team made the right decision to sell the retail centres and stores successively, rather than the portfolio as a whole. This meant that the team was able to achieve considerably higher proceeds in the interests of the creditors.

Real Estate

The insolvency proceedings for the real estate project company Ritter & Kyburz GbR were the talk of the Kempten region in southern Germany. The property is known as the “Big Hole” there since the construction project had come to a standstill for several years after the excavation work had been completed and parts of the underground garage had been built. The underground garage has since been completed. The PLUTA team was able to sell the property with a plot measuring 2,031 square metres. The buyer is a bidder consortium from southern Germany that prevailed in the two-stage bidding process and won the tender as the highest bidder. The property is situated in a prime location in Kempten. Student apartments will be built there. With more than 6,000 students, Kempten is an ideal place for such a project.

Real Estate

GEWA 5 to 1, a project company established for the construction of the Gewa Tower, had to file for insolvency during the construction of the structural shell. When completed, the 107-metre-high tower was to be the third highest residential block in Germany. The company had issued an SME bond to finance the project. After considerable negotiation with various investors, the PLUTA insolvency law experts were able to find a solution for the Gewa Tower. The CG Group, with operations throughout Germany, has acquired the tower near Stuttgart. Instead of the originally planned owner-occupied flats, compact rental apartments are now being created on a floor space of approx. 10,500 square metres. This is not only a good solution for the tight rental market, but also for the bondholders, who will receive a higher-than-average recovery rate.

Publishing

The employees of the newspaper and advertising weekly distributors D & O Werbe- und Vertriebsservice GmbH can breathe a sigh of relief: The well-known Funke media group took over operations at the Osterode location and thus saved the jobs of all 360 deliverers of various daily newspapers employed there. There is also a solution for the Alfeld location: The business operations of the distribution company were sold to an investor from Hanover. All jobs were also retained here. Due to liquidity problems, the newspaper and advertising weekly distributors had to file for bankruptcy. A PLUTA restructuring expert has been appointed insolvency administrator. He and his team led the investor talks, which were successfully concluded.

Publishing

agt agile technik verlag GmbH publishes several trade magazines covering industry, mechanical engineering and woodworking. Given the company’s small size, management began looking for an investor for the highly specialised publisher, with the aim of better exploiting synergy effects. As an investor could not be found in time, the publisher had to file for insolvency. A PLUTA attorney was appointed insolvency administrator. He held further discussions with potential suitors and ultimately achieved an agreement with a well-known investor. Specialist publisher TeDo Verlag GmbH based in Marburg has taken over the business and kept on all freelance and permanent employees.

Automotive Supplier

QSSL Industrieservice GmbH, based in the German federal state of Baden-Württemberg, was a provider of quality assurance services as well as various services for the automotive sector in particular. The company, with several locations in Germany, had to file for insolvency in 2019. Just two months later, the PLUTA restructuring experts managed to find a follow-up solution which ensured that all jobs were saved. The business has been acquired by TRIGO Böllinger Technik from Bremen, the German subsidiary of the renowned TRIGO Group based in France.

PLUTA expert: Ilkin Bananyarli

Automotive Supplier

GfI Gesellschaft für technische Ingenieurleistungen mbH employed many highly qualified people, but sales still declined, as its focus on customers in the automotive sector proved to be a problem. In order to best position itself for other industrial sectors as well, GfI filed an application for debtor-in-possession insolvency proceedings. Management remained in charge and guided the company through the crisis itself. A PLUTA expert was appointed as insolvency monitor by the court to protect the interests of the creditors. The company was restructured during the proceedings and was sold to and integrated into an engineering service provider group with international operations.

Automotive Supplier

The automotive supplier Scheeff, based in the German federal state of Baden-Württemberg, had to file for insolvency some years ago. The PLUTA insolvency administration team kept the business going for almost one year and implemented important restructuring measures. Some 1.5 million euros had to be invested during the insolvency proceedings to meet official and other requirements. Following intensive negotiations, a solution was found for the company. A well-known group of companies from the region with over 1,000 employees acquired the foundry and kept on more than 100 of its employees. Creditors received a recovery rate of more than 20%.

Building materials industry

The British CEO of the Spanish subsidiary of an international group of building suppliers commissioned us, because the Spanish company was in financial difficulties. In this situation, our responsibility was to advise the Board of Directors on potential liabilities and minimizing latent risks.

Circuit board industry

The companies formed part of a global high-tech group of companies, leaders in the development and supply of innovative products and services of the printed circuit board industry. The client, a German citizen, asked us for advice, because the subsidiary was facing a difficult phase. His concern was also the clearing-up of the director’s liability and the corresponding legal protection. In close cooperation with the German insolvency administrators, we launched the formal insolvency proceedings in Spain.

Food trade

One of our client’s Spanish business partners became financially distressed and filed for insolvency. We assisted our internationally active client throughout the whole process enabling him to continue with this business relationship and mitigate risks.

Toy Industry

In 2013, PLUTA Rechtsanwalts GmbH succeeded in selling the Göppingen-based toy manufacturer Gebr. Märklin & Cie GmbH to a member company of the Simba-Dickie Group.

Tourism

nicko cruises, the market leader for river cruises in Europe, had to file for insolvency before the start of the main season. The insolvency administrator, Mr Michael Pluta from PLUTA Rechtsanwalts GmbH, managed to ensure that the tours in Europe, Africa and Asia took place until the end of the 2015 season.

Tourism

The tour operator JT Touristik had to file for bankruptcy because of liquidity problems. Dr. Stephan Thiemann and the PLUTA team have managed to carry out almost all booked trips as planned. In spite of the bankruptcy filing, a total of around 15,000 trips with more than 35,000 people took place. At the same time, during the three months of preliminary insolvency, the reorganization team held talks with potential investors and eventually found a reputable buyer with Lidl. All jobs were preserved. And customers will be able to book trips under the JT Touristik brand in the future as well.

Toy industry

PLUTA sold the Göppingen-based toy manufacturer Gebr. Märklin & Cie GmbH successfully in 2013 to a company of the Simba-Dickie Group. After the insolvency of the traditional company Märklin in March 2009, PLUTA carried out a restructuring process and brought the model railway manufacturer back on the road to success. The insolvency administrator Michael Pluta settled the claims of the creditors by 100%. In total, the payout to all creditors is in the upper two-digit million range.

Tourism

The company nicko cruises, market leader in river cruises in Europe, had to apply for insolvency before high season. Insolvency administrator Michael Pluta from PLUTA Rechtsanwalts GmbH succeeded in ensuring that trips in Europe, Africa and Asia were conducted until the end of the season in 2015. The PLUTA team secured over 30,000 trips, which was an extremely difficult undertaking at the beginning. In addition, the restructuring experts optimised the utilisation of the entire fleet and conducted an investor process. The Portuguese travel agent Mystic Invest successfully acquired nicko cruises. At the official restart on November 1, 2015 the insolvency administration symbolically handed over the keys to the new company.

Automotive industry

At Geiger technologies GmbH, PLUTA succeeded in selling company shares to the Dutch investment company HTP. The automotive supplier Geiger technologies achieves an annual turnover of around 100 million €. Insolvency administrator Dr. Martin Prager achieved the continuation of the company. The District Court in Weilheim opened insolvency proceedings on February 1, 2009. The procedure was completed in mid-2015.

Real estate

The insolvency of a real estate company with 2,400 residential and commercial units was dealt with by PLUTA lawyer Stephan Ammann. Just two years after the opening of insolvency proceedings of BGP Immo-West S.à.r.l. & Co. KG, he succeeded in the complete sale of the properties. These were distributed around seven cities in North Rhine-Westphalia and four cities in northern Germany, including Duisburg, Essen, Bremen and Bremerhaven.

The majority of the real estate portfolio was acquired by the various fund companies of US American Ares Management, LP. In ten further individual transactions Stephan Ammann sold 674 residential units. The sale of the entire portfolio within less than two years shows that insolvency can sometimes be the better way to make decisions in terms of the creditors.

The key to success in the liquidation of real estate portfolios of this magnitude is close cooperation with the secured credit institutions. The common interest in optimal liquidation in this process has made a flexible, cost and purchase price optimised portfolio management possible and contributed decisively to its success.

Technology, media and telecommunications (TMT)

Michael Pluta, Managing Director of PLUTA Rechtsanwalts GmbH and Nigel Atkinson of Begbies Traynor in London, were appointed jointly in Germany and the UK as insolvency administrators and trustees for the non-American companies of the TallyGenicom Group, a renowned and leading printer manufacturer based in the USA.

Michael Pluta sold significant company shares. The insolvency administrator was able to distribute a rate of around 25 percent to the creditors.

Begbies Traynor supported the distribution and service business in Europe as well as the accounting and the IT sector in all EMEA countries and achieved not only a higher rate in Great Britain by selling a large part of British assets and business, but also a more than cost-effective sale of overseas stocks. Creditors with right of separate satisfaction received a full payment, the creditors with unsecured claims received a percentage of the insolvency assets.

Technology, media and telecommunications (TMT)

The insolvency of BenQ Mobile GmbH & Co. OHG (Mobile Abwicklungsgesellschaft GmbH & Co. OHG) was a huge operation. The former mobile phone manufacturer employed over 3,000 people and generated sales of around 2.4 billion Euros. Insolvency administrator Dr. Martin Prager from PLUTA Rechtsanwalts GmbH achieved an insolvency rate of 90 percent for the more than 5,000 creditors.